Introduction

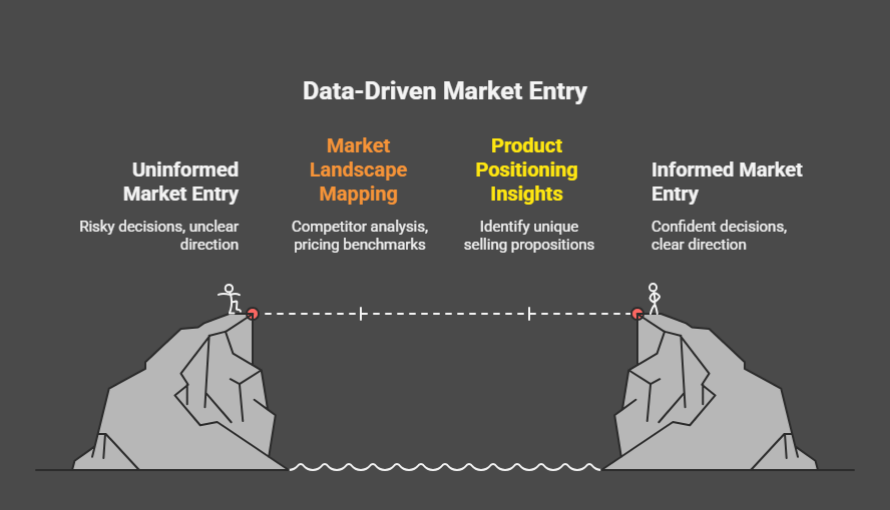

Launching a successful product in today’s competitive landscape requires more than a good idea and sleek branding. Behind every high-performing consumer product is a wealth of insight derived from well-planned and executed market research. Whether you’re introducing a sustainable skincare line, developing eco-friendly baby products, or scaling a home décor collection, understanding the voice of your customer, analyzing market trends, and gauging competitive positioning is essential.

Market research isn’t just a preliminary checkbox—it’s the foundation of every smart business decision. From validating demand and identifying opportunities to refining pricing, packaging, and placement, it plays a critical role throughout the product lifecycle. As a company that specializes in end-to-end solutions for consumer goods, Terranore places market research at the center of every successful launch.

This article explores why market research is the heartbeat of product success, detailing its types, methodologies, tools, common pitfalls, and real-world impact—providing a roadmap for any brand aiming to reduce risk and accelerate growth. At Terranore, we ensure that your product launch process is backed by data, minimizing risk and maximizing results.

What is Market Research?

At its core, market research is the systematic collection, analysis, and interpretation of data about a market, including insights into target customers, industry trends, pricing benchmarks, regulations, and competitors. It serves as a compass that directs product development, marketing, and positioning decisions.

According to global consumer data from Statista, brands that integrate market research early in the product development cycle see up to 35% faster time-to-market and significantly reduced product failure rates.

Market research encompasses both qualitative and quantitative analysis and includes both direct customer feedback and broader industry data. It’s often misunderstood as something to be done once—typically before launch—but in reality, market research is a continuous process that evolves alongside your product and audience.

For example, a brand exploring the U.S. market for eco-conscious kitchenware needs more than a strong design. It must understand customer behaviors (Do they value plastic-free options? Will they pay more for compostable packaging?), competitor price points, and retailer expectations. Market research answers these questions before investments are made in tooling, sampling, or distribution.The insights gleaned from market research guide brands in making confident, informed decisions—ensuring that the product doesn’t just exist but thrives.

Types of Market Research

Market research can take many forms depending on the phase of product development and the questions being asked. These include primary vs. secondary, and qualitative vs. quantitative approaches.

Primary Research

This involves collecting first-hand data directly from potential customers or stakeholders. It’s particularly useful during product ideation, prototyping, and positioning stages. Common techniques include:

- Surveys: Useful for understanding preferences, willingness to pay, and demographic data.

- Focus Groups: Help uncover emotional responses, brand perception, and unmet needs.

- Interviews: Offer deeper insights, often used for B2B product exploration or premium segments.

Primary research is most effective when customized to the brand’s unique category and market.

Secondary Research

This uses existing data from external sources. It’s essential for understanding the big picture—such as market size, regulations, and emerging trends.

- Industry Reports (e.g., Statista, Nielsen)

- Government Data (BIS, USDA, etc.)

- Market Forecasts and Competitive Intelligence

Secondary research often supplements primary efforts and ensures that strategic decisions are aligned with macro-level trends.

Quantitative vs. Qualitative

- Quantitative Research involves numerical data that can be measured. Ideal for demand estimation, forecasting, and A/B testing.

- Qualitative Research is descriptive and observational. It helps decode motivations, pain points, and customer language.

Combining both provides a 360-degree understanding of the market and consumers.

How Market Research Shapes Product Development

Market research doesn’t just help brands avoid mistakes—it actively shapes winning products. Here’s how each stage of development benefits from a strong research foundation:

1. Idea Validation

Before investing in molds, packaging, or inventory, market research answers:

Does the market need this? Will they pay for it? Who are the early adopters?

For instance, a global brand planning to enter the reusable tableware market used targeted surveys across U.S. urban millennials and discovered that collapsible, dishwasher-safe bowls were highly preferred over rigid or hand-wash-only options. This insight saved thousands in redesigns and testing later.

2. Feature & Functionality Decisions

Market research helps prioritize product features based on target audience insights and customer value, ensuring product-market alignment from the start. Should your skincare product include SPF? Should your pet toy be biodegradable or squeaky? Asking customers directly or studying competitors’ reviews can reveal the answers.

3. Packaging Strategy

Understanding how your target audience perceives packaging—minimalist vs. colorful, matte vs. glossy, plastic-free vs. refillable—affects both shelf appeal and sustainability perception. It also ensures regulatory compliance for international markets.

4. Pricing & Positioning

Market research benchmarks your product’s pricing and helps craft a compelling brand message. Are you solving a problem, offering a luxury experience, or making something accessible? Data helps define your competitive edge.

5. Channel & Location Strategy

Insights into where your target buyers shop—Amazon, boutique stores, wellness platforms—inform your distribution strategy. Some products do well online; others require in-store demo experiences.

At Terranore, we combine this data with supplier and logistics considerations to create feasible, scalable strategies that truly reflect customer behavior.

Common Mistakes and How to Avoid Them

Even brands with good intentions can fall into market research traps. Avoid these:

1. Skipping Research to Save Time or Budget

Often startups and fast-moving brands skip research to get to market faster. Ironically, this increases time and cost when products underperform or fail compliance checks.

2. Researching the Wrong Audience

Make sure your respondents are actual potential buyers—not just internal teams, friends, or random social media followers.

3. Misinterpreting Data

Correlation is not causation. Just because a trend is rising doesn’t mean every product within it will succeed. Use layered data points for better decisions.

4. Not Repeating Research

Markets evolve. A strategy that worked six months ago may be outdated today. Repeat research at each key development milestone.

5. Ignoring Compliance-Linked Research

Consumer research should also include regulatory research, especially in categories like skincare, toys, supplements, and baby care. This helps avoid legal issues and product recalls.

Top Market Research Tools for Modern Brands

Technology has democratized market research. Here are tools we use and recommend at Terranore:

| Tool | Purpose |

| Google Trends | Keyword demand tracking and seasonality |

| SEMrush / Ubersuggest | Competitor and keyword research |

| Statista / Mintel | Industry and consumer trend reports |

| Typeform / SurveyMonkey | Customer surveys and polls |

| NielsenIQ / Euromonitor | Market segmentation and retail data |

| Maze / Hotjar | User behavior and experience testing |

Each of these tools enables smarter, faster, and more effective decision-making for product launches.

Case Study: From Market Insight to Retail Shelf

Client: European baby care startup

Objective: Launch plant-based, reusable baby wipes in the Indian market.

The Process

- Conducted a 10-question survey targeting 500 parents across Tier 1 and Tier 2 Indian cities.

- Ran focus groups with mothers using imported organic wipes.

- Gathered competitive intelligence on existing players in natural baby care.

Key Findings

- 64% of parents were unaware of reusable baby wipes but showed interest after learning about benefits.

- Packaging with cartoons or characters increased purchase intent by 27%.

- Most buyers preferred starter packs with 3–5 wipes instead of bulk.

Outcome

- Product packaging was redesigned with friendly illustrations.

- Educational insert added inside the product to explain use and care.

- Launched online and in organic stores; sold 20,000+ units in 3 months.

This is one of many examples where strategic research minimized risk and maximized ROI—something Terranore integrates into every launch journey.

Conclusion: The Market-Driven Advantage

In a world of fast-failing products and evolving consumer behavior, market research isn’t optional—it’s essential. Brands that take the time to understand their audience, segment their market, and validate their ideas dramatically improve their chances of success.

At Terranore, our mission is to turn ideas into profitable, compliant, and scalable products. That journey begins with insight. Whether you’re launching a new skincare formula, introducing a sustainable textile, or entering a new region, we help you map the unknown—so your launch is driven by knowledge, not assumptions.

💬 Ready to start with data-backed confidence?

Reach out today and discover how our market research solutions can de-risk and empower your next product journey. At Terranore, our Market Research Services are designed to help you de-risk development, validate demand, and enter new markets with confidence.